Investment Accounting Software

Supervise investments and make calculations at a lot level with Allvue's comprehensive Investment Accounting solution

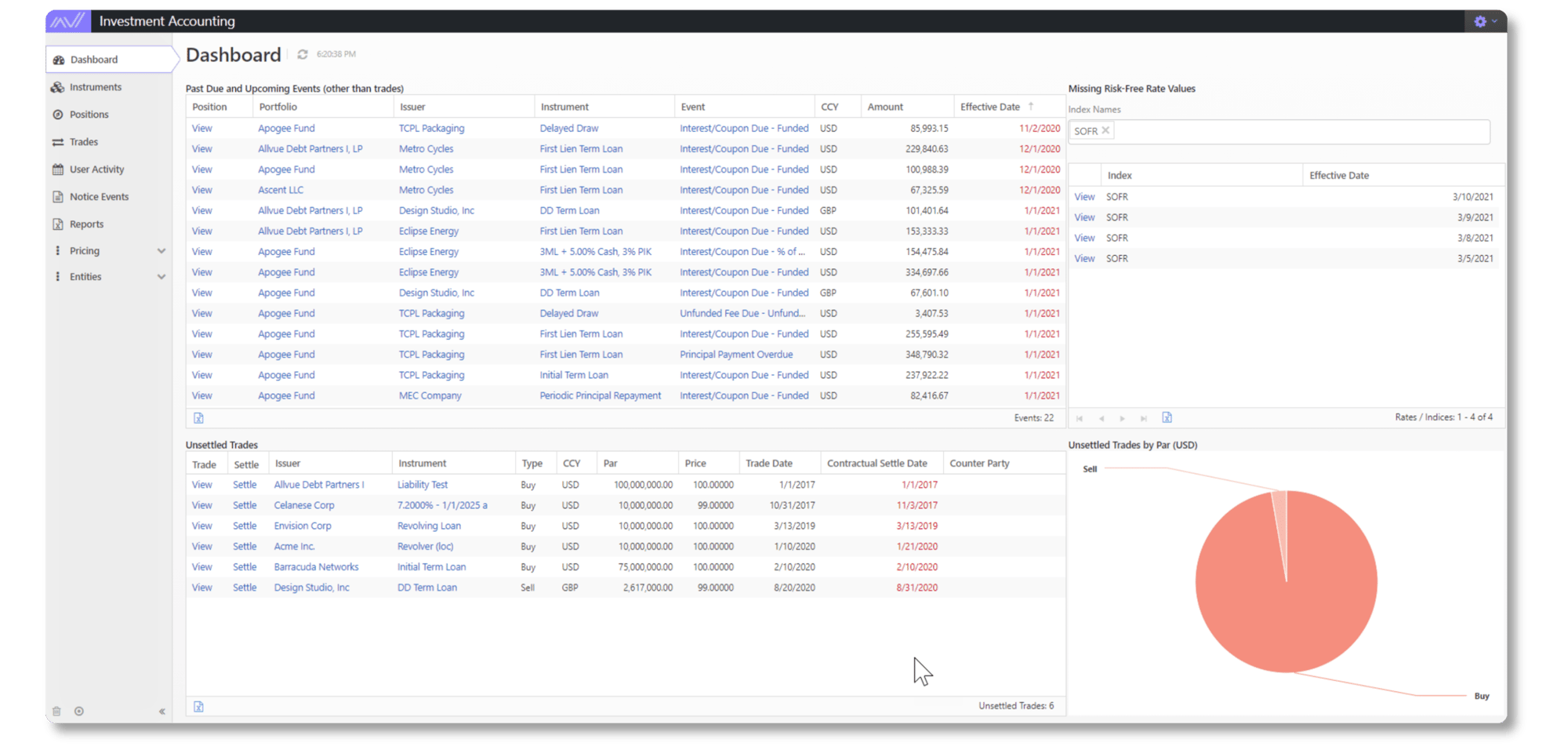

Investment accounting software that can track every transaction

Allvue’s Investment Accounting software is designed from the ground up with proper accounting checks and validation in place on every transaction. Our browser-based investment accounting system allows for easy deployment, scalability and maintenance, and offers seamless integration with our Front Office solution and third-party systems.

✓ Streamlined Workflows

Automate complex processes like carried interest waterfall calculations, simplifying workflows for your fund managers and financial services team.

✓ Risk Mitigation

Integrate your fund’s books and records with your management company accounting or your debt sub ledger.

✓ Intuitive Reporting

Share financial data effortlessly and deepen investor relations via comprehensive investor reporting that both you and your investors can securely access wherever, whenever.

Managing combined credit and equity portfolios

Allvue can help you manage your credit and equity portfolios in one consolidated back office. Allvue’s Credit Investment Accounting subledger seamlessly integrates with our Fund Accounting General Ledger to streamline operations and reduce risk for diversified firms.

The power of a consolidated back office

Allvue’s Consolidated Back Office solution, which combines our industry-leading Investment Accounting offering and our award-winning Fund Accounting solution into a single platform, can meaningfully streamline and de-risk the process of posting your accounting results on a monthly basis.

What you get with Allvue's Investment Accounting software

1 Comprehensive analytics

Track and account for all investments, with the ability to calculate accruals, cash flows, positions, and P&L at a lot level.

4 Dynamic historical insights

Use knowledge date as a natural part of the system architecture, allowing users to generate dynamic historical data.

2 Diverse asset coverage

Supports Broadly Syndicated Loans, Private Debt Loans & Bonds, Corporate & Muni Bonds, and much more with new asset types added regularly.

5 Effortless data exchange

Get data in and out of the system easily via an open architecture (RESTful web-based APIs).

3 Dual record precision

Utilize dual record accounting which provides natural cross-checks, preventing things like “hanging receivables” from going unnoticed.

6 Swift reporting engine

Generate reports faster by pre-calculating and storing key data points at time of entry.

See what our clients have to say

Allvue allowed us to launch a new fund in a modern fund accounting setup as well as have the infrastructure in place to launch a new strategy without requiring additional back-office headcount.

Joachim Satchwell

Associate Director, Polaris

.svg)